HPQ SILICON IS A TECHNOLOGY COMPANY ENGAGED IN THE DEVELOPMENT OF INNOVATIVE, GREEN ENGINEERING PROCESSES.

HPQ HIGH-PURITY SILICON INITIATIVES

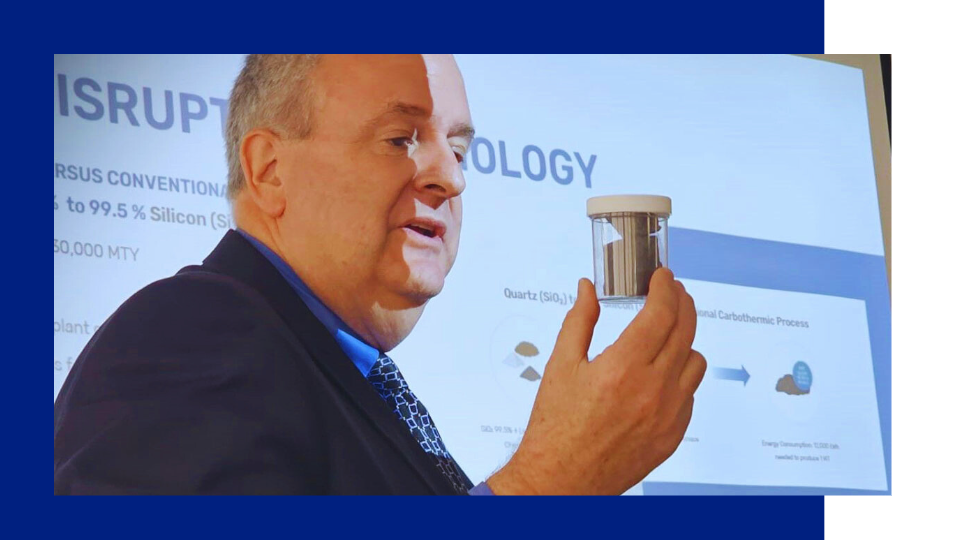

Developing strategic silicon solutions with transformative low-cost technologies.

- Transforming silica into silicon in a more cost-effective and sustainable manner.

- Developing silicon materials for high-value applications — including battery technology, silicon nitride, and more) — in a single step.

- Ensuring scalability of PUREVAP™ technologies with multiple HPQ-owned patent applications.

HPQ FUMED SILICA INITIATIVES

Manufacturing new low-cost green transformation technologies to make sustainable fumed silica.

- Sustainable fumed silica has a wide range of applications, including pharmaceuticals, agriculture, renewable energy, and more.

- Utilizing a plasma-based process, HPQ eliminates hazardous chemicals, HCl releases, and 86% of the energy footprint of fumed silica production.

- Ensuring scalability of HPQ’s fumed silica production through an HPQ-owned patent application.

HPQ HYDROGEN INITIATIVES

Developing a new autonomous process for making hydrogen via electrolysis of silicon and other materials — in a single step.

MEASURED AND ACHIEVABLE 3-YEAR GROWTH PLANS TO START COMMERCIALIZING OUR TECHNOLOGIES.

EXPERIENCED MANAGEMENT TEAM & BOARD SUPPORTED BY TECH PARTNER PYROGENESIS CANADA INC.

STRONG INSTITUTIONAL SUPPORT FROM MAJOR SHAREHOLDER IQ INVESTISSEMENT QUEBEC.

| Major Investors | Basic | Fully Diluted |

|---|---|---|

| IQ (Investissement Québec) | 8.7% | 8.0% |

| Management & Board | 6.3% | 10.4% |

| Strategic Investors | 7.0% | 6.0% |

All quote data are on a 15-minute delay

TORONTO STOCK EXCHANGE: HPQ

| Shares | Volume | Marketcap | 52 Week Range |

|---|---|---|---|

| 421,944,700 | 149,617 | 75.95M |

OTC MARKETS: HPQFF

| Shares | Volume | Marketcap | 52 Week Range |

|---|---|---|---|

| 421,944,700 | 23,050 | 53.17M |

FRANKFURT STOCK EXCHANGE: O08.F

| Shares | Volume | Marketcap | 52 Week Range |

|---|---|---|---|

| 421.944.700 | 1.234 | 43,62 M |

ESG SILICON PRODUCTION

HPQ’s sustainable silicon production technologies, efficient material use, and geographic proximity to green hydropower prime the company to capitalize on growing ESG flows.

HPQ’s ESG advantage in high-purity silicon manufacturing reduces overall costs, greenhouse emissions, and necessary feedstock materials.